How to Reduce the Cost of Acquiring Customers

Are you spending too much to acquire new customers? Learn how to lower your customer acquisition costs for sustainable growth.

No matter how much an organization thrives, attracting new customers is non-negotiable. That’s because not every customer returns, or if they do, they may spend less or order less frequently. Acquiring new customers is a cost of doing business and it’s a significant factor in operating efficiently. Reducing this key metric increases the lifetime value of all your customers. And an increased customer lifetime value means more long-term stability and growth potential.

The Anatomy of the Sales Funnel

The sales funnel can be a useful visual for understanding the importance of customer acquisition costs. As the customer journey progresses, the funnel inevitably gets ‘skinnier.’ That’s because at each stage, fewer prospective customers move forward with their potential purchase. And inevitably, some customers won’t return, creating a constant ‘leak’ out the bottom of the funnel.

Here are the sales phases – and how to identify where your funnel leaks exist.

- Awareness – This is where potential customers become aware of your brand, product, or service. If there’s a leak here, it’s usually one related to traffic. No one knows you exist or how to find you.

- Consideration – This is where your value proposition should pique someone’s interest. If there’s a leak, it means that no one knows why they should buy from you.

- Preference – This is where potential customers determine whether or not your product or service can meet their needs. If there’s a leak here, it’s because they don’t know how your value proposition relates to them.

- Purchase – This is the biggest conversion point: where they buy from you. If there’s a leak here, there may be something wrong with the way your purchase system is set up, or other factors like price or shipping costs.

- Loyalty and Advocacy – This is where customers have a great experience, purchase from you again, become loyal customers and then share and promote your products and services with others. If there’s a leak here, it means that your post-purchase strategies are failing.

A Deep-Dive into Customer Acquisition Cost

What It Is and What It Tells You

So, what does it cost to help prospects move from the top to the bottom of the funnel? It’s a metric called customer acquisition cost, or CAC. Calculating your CAC is fairly straightforward.

And while the math is simple, what’s more challenging is collecting the numbers to input into the formula. This includes:

1. The salaries of sales and marketing employees (plus commissions and bonuses)

2. Your advertising spend

3. The development of any sales collateral (including graphic design work and printing costs)

4. And any software or systems, like a CRM or email marketing tool

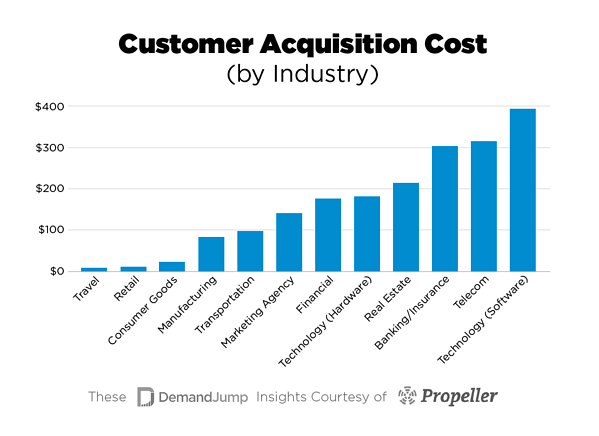

What constitutes a strong customer acquisition cost vs. a weak one can differ greatly from industry to industry. As you might imagine, retail and consumer goods generally don’t have to spend much to attract new customers. Technology, real estate and insurance, on the other hand, have high competition and very little repeat business.

Aside from industry benchmarks, one way you can determine a good CAC is by comparing it to your Customer Lifetime Value, often known as CLV. It’s thought that an ideal Lifetime Value to Customer Acquisition Cost ratio is 3:1. However, keep in mind that your benchmark is against yourself. It’s not a race against your competitors, though lowering it will give you a competitive advantage.

Source: https://www.demandjump.com/blog/customer-acquisition-cost-by-industry

Lowering Customer Acquisition Cost

Once you know your customer acquisition cost, it’s time to figure out how to start lowering it. Here are five aspects to consider:

Know your audience

The more you know your audience, the less time and resources you will have to spend on guesswork. Understand how they think, what channels they’re on, and how your value proposition resonates with them. You can engage with customers for piloting different channels and tactics to gather insights.

Refine your advertising

There are so many advertising and marketing opportunities available today, but not all of them will be right for your business. Some will absolutely be more effective at reaching your ideal customer and getting them to buy from you. But no matter where you buy ads, make sure to use persuasive, action-oriented language that explains how customers will benefit from your product or service. Make it more about them, less about you.

Retarget for cost effectiveness

Social media allows you to retarget people who previously showed interest in your website or ads. This is often a cost-effective tactic. Maybe they visited your website, clicked on an ad, filled out a contact form, or liked your Facebook page. Whatever action they took showed some intent to purchase and making sure you don’t lose their attention may be an easier path to conversion.

Invest in technology

Another way to improve your CAC is to leverage tools or systems that require less manual work from your employees. Sometimes an investment in a software or technology can actually pay off because you spend less on salaries – or allow your employees to focus on higher-value work. Two primary tools to consider are 1) a customer relationship management system (CRM) and 2) an automated marketing email platform.

Objectively evaluate your online presence

Make sure it’s easy for customers to find what they want or need. Look at your website and social channels, and do your best to put yourself in your customers’ mindset. Momentarily forget everything you know about your solutions, products, competitive advantages and see if those messages are truly getting across. If you had a question, could you find the answer based only on the information in front of you?

Reigning in customer acquisition costs is a big part of managing and embracing growth. To learn more about growth marketing, email us at inquiries@standingpartnership.com.